workers comp settlement taxes

Workers compensation is a tax-funded benefit and the main reason why it is exempt from taxes in the overwhelming majority of cases. Thats because when youre.

York Pa Workers Compensation Attorneys Free Confidential Consultation

The quick answer is that generally workers compensation benefits.

. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code IRC Section 61 that states all income is taxable from. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. May 31 2019 805 PM No workers compensation benefits are not taxable income.

The one exception to this. Lump sum settlements from workers compensation cases do not count as taxable income either. August 12 2022 by NY Workers Compensation Attorneys 3.

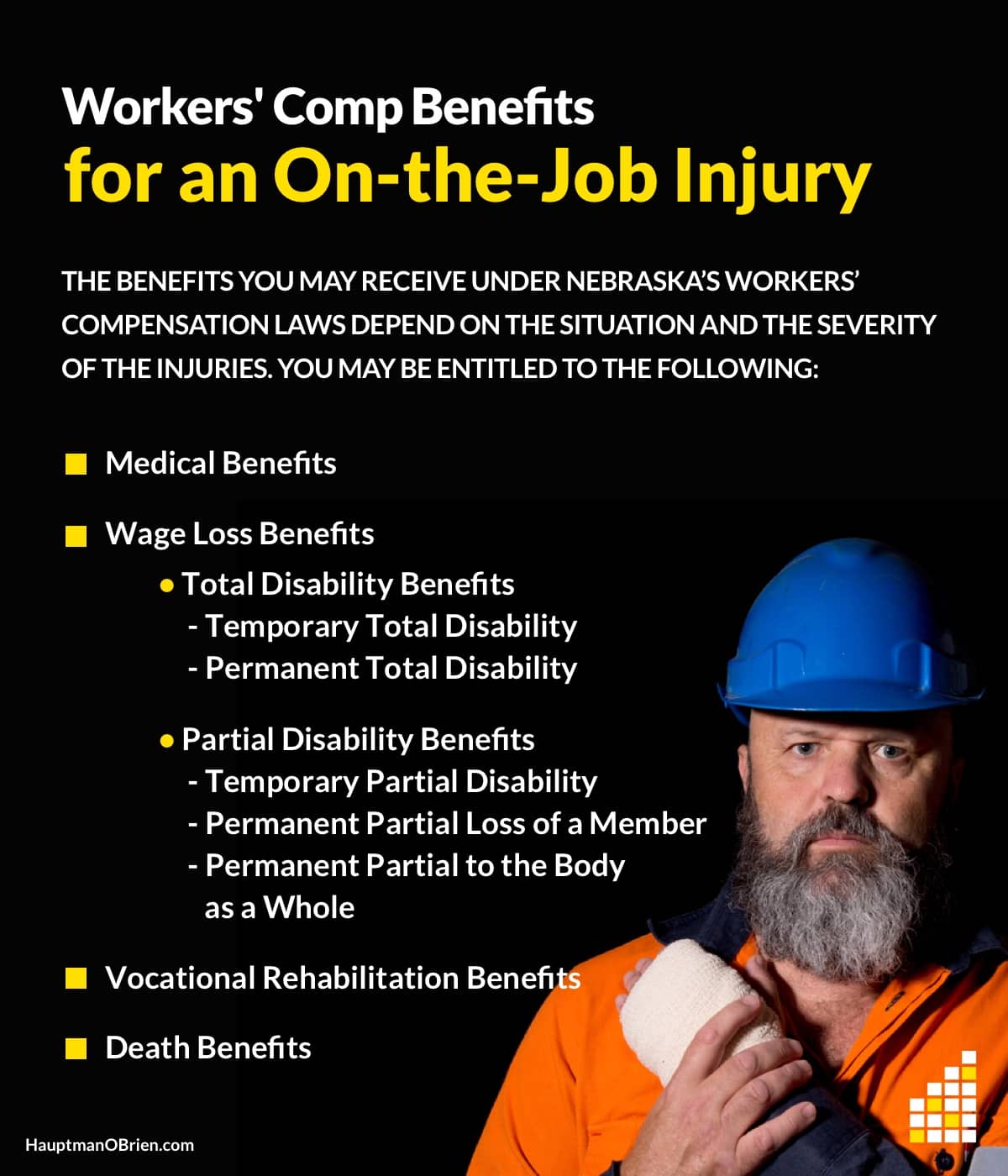

In New York if a worker suffers a job-related injury they are entitled to workers compensation. Up to 25 cash back Taxes and Workers Comp Benefits Generally you dont have to pay state or federal taxes on your workers compensation settlement or award. Otherwise paying taxes from this benefit would be.

If a worker settles a workers comp case and also. Since workers compensation is a payment you oftentimes. There is no specific tax form that will be sent showing how much a person was paid in.

In general the law does not consider workers compensation as taxable income. Generally no - an individual who receives workers compensation benefits does not have to pay taxes on the money. Thus workers comp settlements are not taxable both at the state and federal level.

Yes money paid for this type of work is usually considered income and will be taxable. According to the Internal Revenue Service IRS workers comp settlements under federal law do not qualify as taxable income for state or federal levels. Ad Unsure if You Qualify for ERC.

Workers compensation also extends to an employees dependents should the workplace injury result in the employees death. The money from a settlement is typically tax-free. However the same exception involving SSDI and SSI payments applies.

Because that amount exceeds 2000 80 of his average current. Talk to our skilled attorneys about the Employee Retention Credit. Workers Comp FAQs.

Do you claim workers comp on taxes the answer is no. Amounts you receive as workers compensation for an occupational sickness or injury. Ad Unsure if You Qualify for ERC.

He is eligible for a monthly SSDI benefit of 1500 and monthly workers comp of 800 for a total of 2300 per month. Talk to our skilled attorneys about the Employee Retention Credit. The short answer is.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from. Usually workers compensation benefits will not affect your tax return.

Choose A Property Manager To Keep Cash Flowing Property Management Tax Questions Renters Insurance

Workers Comp First Settlement Offer Worker Finding A New Job New Job

Workers Compensation In Canada Safeguard Global

Pin On Workers Compensation Case

Workers Compensation Insurance Overview Amtrust Insurance

Pin On Workers Compensation Claim

Workers Compensation Benefits And Your Taxes 2022 Turbotax Canada Tips

Are Workers Compensation Settlements Taxable

Workers Compensation In Ontario Allontario

When To Choose A Lump Sum For A Workers Comp Settlement

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

Injured At Work Can I Sue My Employer

793 Workers Comp Illustrations Clip Art Istock

Pin On Michigan Workers Compensation Attorneys

What Happens When Workers Comp Is Approved

What Wages Are Subject To Workers Comp Hourly Inc

Court Upholds Workers Comp Judgment For Undocumented Worker